Keeps track all your debts, loans, interests and incorporate in your budgetĮnables payment and collection in multiple currencies.įacilitates payments for bills, membership, donation, etc. Monitors the performance of savings and investments

Prepares a plan to spend your money by balancing income and expenses.Īllows to categorize or group the transactions with common attributesĪll in one dashboard that presents the financial performance. Provides reminders or notifications when a deadline is approaching, an upcoming event or a pending taskįacility to add manage purchase bills and get reminded if bills are due

#MONEYWIZ VS MONEYWIZ 2 FREE#

Their app is free and available on both apple app store and google play store.

Charts and reports, Keep track of your income and expenses according to categories. You can keep track of incoming spending, monitor your account balance on any given day, and see upcoming expenses using their transactional forecasting calendar! Enter your recurring transactions in Recurring Transactions. One of their most beneficial features is their financial forecasting calendar - Uncertain of your progress toward a given amount? Miza is aware. Based on your income and outgoings, Miza automatically updates their progress. To achieve healthy personal finances, they have incorporated the fundamental financial objectives. It has a vast list of features such as - Budgeting automatically, Miza creates your budget for you by employing well-known budget splitting techniques like the 50/30/20 rule. One may ask what transactions require tracking. The synergy occurs as soon as the most significant recurring expenses are entered. Let's take the reins and put budgeting and financial review on autopilot. Miza is a personal finance management software. Individuals, Small companies make use of the software. Collaborate with teams to identify trends and setup budgets to monitor your track with goals.

#MONEYWIZ VS MONEYWIZ 2 SOFTWARE#

The software offers tools to up-to-date view of your assets, liabilities, and spending. Monarch Money is a platform used to track accounts and analyze your investments to achieve your goals. The tool also enables users to set up budgets and goals to meet personal finance goals.read more Moneywise gives a comprehensive view of all the Banks, Credit cards, Investments, Expenditures, Wallet balances, Loans, and Receivables of the user.

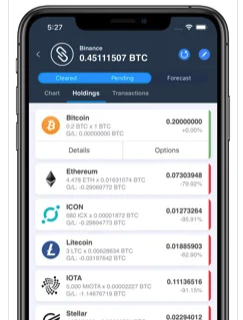

Users can also set up reminders for payments and card bills. Users can keep track of their daily and monthly spends across various categories like Fuel, Groceries, utility payments, etc. MoneyWiz allows users to easily modify the existing shareholding to adapt to any share split or even bonus allotments. The tool offers users customizations in terms of colors and logos for each category. Its features include compact layout, easy swipe across categories, bulk edit and delete, intuitive display, smart analytics on credit utilization, and balance available. MoneyWiz also works with Plaid, Yodlee, and SaltEdge as an added advantage. It offers direct sync with more than 20,000 banks across 50 countries. MoneyWiz is a powerful personal finance tool that helps the user keep track of their finances.

0 kommentar(er)

0 kommentar(er)